Small Cell installation service vs Passive DAS & Active DAS installs

Oct 27, 2017

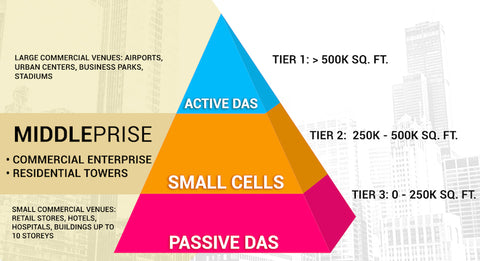

For large areas that require 3G, 4G, and LTE Plus or Advanced signal boost, there are several cellular boosting installation options available to improve mobile reception. Passive distributed antenna systems (Passive DAS) also known as cell phone signal boosters are great for lower end of square footage spectrum up to 250,000 sq. ft. Active distributed antenna systems (Active DAS) are good for higher end of square footage spectrum over 500,000 square feet. For areas between these, a Small Cells system may be the solution that hits the sweet spot for price and strong wireless coverage. While small office, home office (SOHO) can certainly use the micro version of Small Cells (femtocell) instead of a cellular signal booster, the version we're referring here, is "Enterprise Small Cells" for large spaces 250k - 500k sq. ft. This category is the tier 2 which our small cell installers refer to, as "Middleprise".

1. Overview.

Mobile data traffic is increasingly growing, with the main drivers being high bandwidth applications (Apps) and an ever increasing number of devices that are data capable. Many operators are constantly looking at their options, and up to 60% consider small cell installation as a high priority as a critical component of their 4G service. Many big operators including Vodafone, AT&T and Softbank are leveraging their macro networks and strive to differentiate themselves through small cell solutions. In 2016, small cells serviced up to 25% of mobile traffic and small cells shipments reached a value of more than $20.4 billion.

Small cells can be defined as low-powered wireless access points in the licensed spectrum.

Small cells are primarily used to improve cellular coverage, applications and capacity not only in homes and businesses, but also in rural and metropolitan public spaces. Technologies used includes so-called pico cells, femto cells, metro cells and microcells.

When looking at potential small cell strategies, both short term challenges such as saving costs and longer term challenges, such as creating new revenue streams and improving customer loyalty should be taken into account.

Implementing small cell installation strategies is normally done by following these steps:

- Saving in Total Cost of Ownership (TCO) while improving capacity and coverage.

- Prioritizing rollout to increase revenue.

- Using integrated broadband to improve customer experience.

- Testing innovative services to explore new revenue streams.

There are however some major challenges that have to be dealt with when implementing small cell technology. These include:

- Suitable backhaul availability.

- Acquiring and operating small cell sites.

- Monetizing and integrating small cell installer technology.

While complexity is added through adding and having to maintain thousands of new sites, operators face both commercial and technical challenges that need to be addressed to ensure profitability and ease of installation.

2. Why are Small Cells needed?

2A. Heterogeneous Networks (HetNet).

When operators want to improve their capacity or coverage they have a number of options that should be considered:

- Migrate 3G users to 4G. This will help them capitalize on 4G’s spectral efficiency and could result in a capacity gain of up to 6 times.

- Buy additional spectrum. This is normally an expensive option, but it result in a capacity gain of up to 3 times.

- Install small cells. This will increase for spatial efficiency and could result in a capacity gain of up to 56 times.

To build enough macro cells to service all the demand is financially very difficult to achieve. Small cells are however cost-effective and could therefore be used relatively easily to reduce the gap between data capacity and demand. Today’s consumers demand a high Quality of Experience (QoE) network that is available anytime, anywhere. This has resulted on the network evolution being driven towards Heterogeneous Network (HetNet). This integrated network consists of Wi-Fi Access Points (AP), small cells and macro cells. The architecture of HetNet enables the operator to expand capacity based on actual rather than forecast demand.

2B. Traffic growing exponentially.

It is estimated that there will be more than 50 billion connected devices across the globe by 2020. The biggest growth is experienced in mobile traffic and it is expected to overtake fixed data traffic in 2019. Bandwidth demand is already more than the supply from macro networks in some areas. The result is poor service quality, leading to a higher churn rate (customers switching from one provider to another) and this increases customer retention costs.

Mobile data traffic is not evenly spread out, but varies across time and locations. This make is very difficult to plan for capacity requirements.

- Time: In general, WiFi data consumption is lower than cellular during the daytime, while during the night, cellular data consumption is lower than WiFi.

- Locations: 10% of the cells that serve dense areas handles 90% of the data traffic, while 80% of traffic is generated indoors.

3. A strategy using small cells.

It is logical for operators to leverage their strengths in Macro networks and then to extend these to small cells. An appropriate small cell strategy is often determined by the operator’s strengths in the cost structure of its network assets and in its subscriber mix.

Any holistic strategy for small cells should look at both short term challenges such as network TCO savings and long term challenges including exploring new revenue streams and improving customer loyalty.

3A. Integrating WiFi and small cells.

Additional coverage and cost-effective capacity for delivering seamless data services can be achieved by integrating small cells with Wi-Fi. This could lead to a saving in TCO and an increase in revenue:

TCO saving.

- Lower CAPEX and site rental.

- WiFi can provide an effective wireless backhaul.

- Improving service quality leads to savings in Subscriber Retention Cost (SRC) and Subscriber Acquisition Cost (SAC).

Increase in revenue.

- Data use is increased by extending data services to non-cellular devices.

- Monetization of WiFi and "premium" data services are made possible by intelligent offload policies.

- New revenue can be realized from enterprises and venues through hosted WiFi services and Carrier-managed VAS.

Integrating WiFi and Small cells can be achieved either in the Core or in the RAN. Both integration options present a trade-off between the ease of monetization and the complexity of integration. Three major integration options are generally used to increase revenues:

- Operators can introduce inventive pricing strategies through core integration with Access Network Discovery and Selection Function (ANDSF) and Hotspot 2.0. This will however be limited by billing engine functionality.

- Operators can bundle existing 3G/4G data plans with WiFi services through RAN integration with automatic WiFi authentication.

- Operators can offer carrier-managed VAS with fully capable WiFi/4G devices through advanced integration that includes policy control for specific traffic flows.

3B. Enhancing coverage and capacity.

Small cells installers mostly install to enhance capacity and coverage. Small cells are often installed to provide:

- To service apartment buildings or Small Medium Enterprises (SME) offices or at the cell edge, extended coverage is provided at the cell edge.

- A tall office tower often creates a large coverage blind spot. This can be serviced by a small cell outdoors to provide coverage infill.

- Peaky or uneven demands on capacity can be addressed cost-effectively by using a combination of indoor and outdoor small cells.

QoE improvements are only possible if the right customer experience is delivered at the right time in the right place. Improving QoE can lead to improved revenues from consumers and enterprises.

Global investments in small cells is driven by the need to deliver QoE. Small cells are ideally positioned to not only add to, but also substitute macro networks in an effort to eliminate the gap between demand and capacity for data.

This strategy can be expanded to provide Small Cell as a Service (SCaaS) and Fiber as a Service (FaaS) to MNOs in exchange for an MVNO deal to enter the mobile service market.

3C. A business case for small cells.

The small cell business case is driven in part by revenues from location-based apps and other new applications, and revenue from increased data usage. A big part of the business case also relies on savings in SRC and SAC from improved loyalty due to a high QoE, and increased Customer Lifetime Value (CLV).

To reduce both OPEX and CAPEX, operators are sharing more of their macro network infrastructure, for example as a Multi Operator Radio Access Network (MORAN). When small cells are deployed astutely, they can be a great source of competitive differentiation and advantage. This can improve customer experiences and revenues, while reducing TCO by at least 40% at the same time.

To make the business case and to achieve the competitive advantage for small cells, operators need to define when, where and how to deploy small cell solutions, and align this with customer requirements.

4.Improve capacity and coverage to reduce TCO.

Reducing TCO through implementing small cells is highly sensitive to changes in site rental and backhaul costs. The TCO of small cells is attractive due to savings from backhaul solutions and the choice of cell sites.

4A. Acquiring and maintaining sites

In order to achieve the potential lower cost per bit small cells can achieve, operators must be exact about where they install capacity. To address the demand for data services, a number of different options can be used and each of these have a number of pain-points when installed.

When small cell solutions are deployed by certified small cell installers, an order-of-magnitude increase in number of cell sites has to be managed, hence a flow of events different to that of macro site acquisition and installation has to be followed. New challenges in handover configurations, interference management, and operational and maintenance processes are created when a large number of small cells are deployed. Handover and interference issues can be resolved by using technical solutions such as Coordinated Multi-Point (CoMP) and Self Organizing Network (SON). This would ease the commissioning process and reduce OPEX.

Operational risks can be significantly mitigated by using astute contract management with third party commissioning and installation contractors.

Operators should change existing installation processes and determine which activities create differentiation in QoE. Ideally, these activities should be done in-house, while the others could be outsourced.

For commercial high-rise buildings, negotiating with landlords to deploy small cells that are only activated on demand is a way to provide high speed data connectivity effectively. To commission and maintain these installations, extended access to building premises will be required. This could include access outside normal business hours and access to secure areas. Vendors should negotiate these access requirements carefully if they are to meet strict Service Level Agreements (SLAs). It is often the simplest option to use a single vendor for commissioning and maintenance.

For customers other than enterprises, site acquisition challenges depend on many factors, including on whether installation needs to be outdoors or indoors, and the population density in a specific location:

-

Public outdoor. These sites can either be contracted out or self-installed, with either option having pros and cons. Although contracting out SCaaS and FaaS agreements with a fixed broadband operator allows for easy access to backhaul/power and sites, there is little to no competitive advantage.

Site selection is the main driver for market penetration, and these need to be negotiated with the relevant authorities such as municipalities for access to for example street furniture including lampposts. Operators should plan for multiple backups by engaging real estate agencies for agreements to install on outer buildings, or billboards at intersections. Ensure that the agreements include access to in-building fiber and power to service the small cells.

It is logical to contract out physical installation of small cells to utility maintenance companies who should have normal access to relevant facilities. - Public indoors. Owners and local authorities could be approached to expand and maintain in-building backhaul at sites such as airports and shopping malls. Backhaul capacity can be purchased from, and maintenance contracts entered into with local authorities to complete the business case. Distributed Antenna System (DAS) sharing and SCaaS between operators assist the operations of small cells in these hotspot locations.

- Rural and Suburban. The business case for small cells in rural and suburban areas can be challenging because the data demand in these areas is often low. Horizontal pico-cell solutions is therefore often a viable option, providing there is no regulatory obligation for wider coverage. Provisioning of broadband in villages and small towns with low populations moves the nature of the challenge from reach- to capacity-constrained. This means that the bottle-neck in service provisioning to a village is often backhaul.

- The absence of street furniture in sub-urban areas can be solved by using telescopic towers such as Rapid Deployment Sites (RDS), thereby providing outdoor coverage with a small footprint.

- Mandatory coverage laws and low demand make RAN sharing a key solution for remote areas.

- With sparse cell sites dictate that the installation and maintenance be contracted to utility companies. In such cases, increased stock levels should also be maintained at support centers close to the villages.

- A number of technologies can be mixed and matched for access infrastructure, including copper, fiber, satellite and wireless. It may however be difficult to absorb the economics of doing this.

4B. Backhaul.

Backhaul faces some unique challenges when diverse deployment scenarios are used. It is crucial to use the appropriate solution for each case, for example in public access small cells, where a fiber backhaul could be prohibitively expensive. Operators can leverage existing assets by joining various backhaul technologies together to reduce TCO.

-

Wireline backhaul solution could be via fiber or copper. Gigabit Passive Optical Networks (GPON) provide extremely high performance for fiber.

The Next-Generation Passive Optical Network (NGPON) is becoming increasingly popular with operators to deliver high-speed apps. Bandwidth requirements for commercial users is targeted at 1Gbps while residential users are targeted at 100Mbps. NGPONs are split into two phases: NG-PON1 offers 2.5G upstream and 10G downstream, while NG-PON2 achieves 40G access based on Wavelength Division Multiplexing (WDM). The NGPON evolution is facilitated by rapid small cell roll-outs.

Operators that don’t currently have wire line assets, may choose to install to lease. It is costly and time consuming to install any wired infrastructure, while leasing fiber is often quite expensive. An attractive option for operators is therefore often fiber-complementing wireless backhaul solutions. -

Wireless backhaul solution has the advantages of reduced costs and a shorter time to market for a small cell roll-out.

Various wireless solutions such as microwave, NLoS and LoS are available. These solutions each present a trade-off in the frequency, propagation and topology they support. In the case of for example short range street level coverage, it is logical to use spectrum bands that require little to no licensing fees to reduce costs.

It is predicted that outdoor small cell units will grow to more than 3.5 million units by 2018. As outdoor small cells become more popular, the focus will shift to the unlicensed 60GHz (V-band) as an ideal micro/metro solution at street level.

The benefits of V-band backhaul are:

- Installation requires low skilled labor.

- Low TCO per Mbps.

- High capacity.

- Environmentally friendly.

- Low latency.

It seems clear that a combination of wireless and wired technologies is required for both indoor and outdoor public hotspots.

5. Prioritize rollout to increase revenue.

Traditional revenue streams can be increased by increasing data usage through smart tariff plans and enhanced capacity, and reducing churn through enhanced coverage.

Research shows that outdoor data use increases by about 30% when QoE is improved through small cells solution implementation. Improved customer experience also leads to a reduced SAC through easier new subscriber acquisitions, and better loyalty leading to reduced SRC and increased CLV. The decision on which segment to target first is therefore of utmost importance.

Residential properties, with poor coverage, both in rural and urban areas, could be improved with femtocells. Residential femtocell installation has however failed to address capacity issues in the mobile industry, due to the lack of a sustainable business model and a high dependence on existing backhaul infrastructure.

Public hotspots experience peak traffic regularly. It is expected that the higher demand for data will continue and more than half a million public small cells were deployed internationally in 2015. A better QoE is achieved through improved data access in public areas and this contributes to an improver CLV in the longer term.

Areas with regular "peaky" traffic are identified through data demand analysis. Operators can optimize shared resources such as macro coverage and backhaul in these areas. Macro beam-forming technologies can for example be set up to focus on buildings during office hours and on the street during rush hour.

The type of small cell install in public areas is determined by data demand in hotspots and user densities determined through smartphones. Micro/ Metrocells or Picocells can be deployed in these areas to reduce capacity bottlenecks, and also to provide cellular coverage in spaces that have poor macro coverage. Multiple operators can jointly install DAS in public indoor spaces including service malls.

Not only can small cells supplement macros by increasing capacity, but they can also substitute macros to address peaky and sparse traffic. Potential revenue increases from small cell installation can be determined through crowd-sourcing.

Enterprise is a lucrative market for operators due to the higher ARPU, with the growing trend in Bring Your Own Device (BYOD) and increasing smartphone use. A good QoE at work could influence employees to switch their personal contracts to the same operator. The enterprise should therefore be a small cell rollout’s primary target.

The SME market is vast, and SMEs are increasingly looking for a single source solution to address all communication needs. If a small business has fixed broadband, the strategy could integrate the small cell and a WiFi access point in a single box. SMEs should be sub-segmented to identify companies where consumers spend idle time and subsidize small cell solutions to those businesses, for example, launderettes and hairdressers.

Offices buildings with poor voice coverage strengthen small cells' business case, as small cells offer advanced presence/voice/ video services and excellent voice quality for corporate users. Although building sizes for business premises vary widely, 39% to 61% of offices have poor in-building coverage and an estimated 87% of businesses have indicated that they would move to a different provider if this guarantees coverage. To cater for different building sizes, operators can use Femtocells in smaller buildings and Picocells in large buildings.

6. Use integrated broadband to improve customer experience.

With an increasing number of OTT apps appearing in the mobile market, operators must look at their network capabilities beyond capacity and coverage. An improvement in QoE will lead to consumers being prepared to pay for services such as mobile TV, combined cellular and WiFi broadband, and up- or downloading User Generated Content (UGC).

User generated content: As most user generated content is instant, it creates a ripple effect of numerous downloads on mobile devices, anytime, anywhere.

The amount of information consumers create and share by lies at the heart of revenue opportunities in the consumer segment. It is predicted that content generation by users will double every two years, mainly through the growing video upload trend. YouTube uploads have increased tenfold in the last six years. Some of the growing trends are listed below:

- Platforms such as Snapchat enable users to chat by including multimedia (videos and pictures) and messages that expire encourage the posting of new selfie videos.

- Social sites including Facebook and Instagram note that posting selfies is a growing trend. When uplink bandwidth increases, this trend will likely spread to videos.

- Capturing and uploading of real-time video at events and concerts.

Mobile TV subscription: As broadband coverage and speed improves, it is predicted that live mobile TV consumption will grow aggressively. Technologies such as Digital Multimedia Broadcast (DMB) and enhanced Multimedia Broadcast Multicast Service (eMBMS) deliver rich media services to the masses, and operators are following these trends with interest.

Various South Korean operators have adopted DMB technology early, and are competing to increase their subscriber base for mobile TV. In South Korea, catch-up TV already constituting more than half of total viewing.

- KT's Always Best Connectivity (ABC) solutions switches between 3G/LTE and WiFi intelligently for Internet access. QoE is enhanced with ABC solutions, as users no longer need to verify access speed before watching a video. It also reduces cellular data charges by as much as 80%, while battery usage is improved by 40%.

Monetize WiFi services: WiFi can be monetized together with 4G and 3G services by integrating a WiFi network with Macro and Small cells. A wide range of integration options are available, but the go-to-market strategy is often determined by the integration’s scope. Seamless WiFi offload policies can be configured based on type of app, user segment, QoS or network congestion.

The overall end user experience can be improved by the use of intelligent policy controls such as Next Generation Hotspot, Hotspot 2.0 and ANDSF. These allow users to connect to WiFi automatically, whenever and wherever it is available.

Data from cellular and WiFi can be monetized separately through core network integration for separate WiFi access networks and small cells. Approaching WiFi monetization in this manner does however require an extensive WiFi rollout strategy to allow WiFi network to compete with 3G/4G cellular networks. Apart from the revenue generated from ‘pure’ WiFi, the improved QoE will attract new customers and reduce churn.

7. Use innovative services to generate new revenue streams.

Growing multimedia consumption on mobile devices and an increased interest in personalized sales offer new revenue opportunities for a quicker ROI on small cell installations. Consumers will however expect businesses to offer services such as video phone-ins and video conferences that blend into their context and usage.

Video conferences, conference calls and phone-ins: Sectors such as insurance, education, news media and health are increasingly using mobile technology to reduce cost and improve QoE. Two-sided business models can established to increase data revenues. When enterprise sponsored data packages and small cells are deployed widely, it encourage users to use video call services and upload recorded videos.

Smart connected homes: Small cells allow home automation and improved living with location sensitive features. Small cells also enable use cases such as care for the elderly, home surveillance, and for children to be monitored.

Insurance: Cameras mounted on the dashboards of a car (dash-cams) are very popular in parts of the world and their recordings of traffic accidents is permissible as court evidence. Dash-cams are also widely used by insurance companies to fight insurance fraudsters.

Health and emergency services: Health and Emergency and services can use micro location information from small cells to locate emergencies. One simple applications is a panic button that dementia patients can press to call for help. Video phone-ins for doctor consultations can for example improve the convenience and efficiency of health services.

Education: A combination of online, classroom, and mobile learning, called blended learning, is set to revolutionize education. The traditional educational model will be inverted with lectures being watch on mobile or online, while discussions and activities from the lecture will be done in the classroom. Younger generations will however not only learn through multimedia, but will also interact with their teachers through video conferences and phone-ins.

Personalized services: Consumers are increasingly demanding personalized experience from services and products. Presence and location information is critical to enable personalized services, and the service has to blend in with the user’s context. To provide personalization, operators must secure the best sites to deploy small cells and enable location, position and presence aware solutions.

Automated news feeds are increasingly sponsoring users to upload news at zero cost. Operators can for example charge CNN for every iReport that is uploaded using a cellular network.

Customer service through video calls lead to faster resolution of problems and improve the QoE of customers.

Wearable devices: Wearable devices such as Samsung Gear and Google Goggles use Augmented Reality (AR) applications that need micro-location information that can be provided by small cells. This is not limited to location information, but could include the wearer’s interests, favorite places and activities to present relevant information.

SME: Small cells can be used in SME premises to alert the company of frequently visited customers. Commuters can for example order coffee on their mobile and when they are close to the shop, a small cell will flag this information to the shop assistant, who can then prepare the order, ready for collection when the commuter arrives at the shop.

Enterprises: Employees could use their smartphones as ID by using real-time location services to enable access to the office, or conduct a video conference on their device of choice (i.e. BYOD).

Proximity APIs: Businesses would be interested to know when existing or potential customers are close to their shop. An Evernote grocery list on a user’s device could for example trigger the store to send coupons while the user walks past the store.

Presence APIs: Offers, coupons and mobile advertising can be targeted specifically to users when they enter or leave a business environment.

Social APIs: Users can find their contacts in places nearby by using presence information from small cells. Local businesses can use a combination of user interests and nearby contacts to target specific offers, a nearby sports bar can for example send special offers to two friends both interested in football.

Location tracking APIs: A wide range of positioning APIs can be made available to retail businesses through small cells. Bluetooth based technologies allow very precise tracking of user location, but their range is very limited. Small cells could be used to provide the initial tracking of user location, handing over to tracking systems based on Bluetooth in closer range. Integrated APIs can then provide user location and identity inside the store. This information could assist retailers in offering services and products depending on which aisle the shopper is in.

8. Summary.

Small cells’ future is promising, and there are many opportunities for those who understand when, where and how to deploy them. Small cells address capacity boost and coverage infill scenarios, while improving user's QoE at the same time. The four major benefits to small cell rollouts are reduced network TCO, increased data revenues, improved customer experience (QoE), and potential new revenues.

Successful small cells business cases depend on an increase in CLV and savings from SRC and SAC due to customer loyalty improving. This loyalty can be achieved when the right QoE is delivered to customers at the right time and the right place. Operators need to approach installing small cells differently and understand how to manage and change the deployment process. They will also need to find a solution for the lack of ubiquitous fiber backhaul. Site selection, and both operating and maintenance models for small cells will be key to realize a competitive advantage.

Indirect revenue can be gained from improved loyalty and decreased churn. Improved QoE will drive up usage, which will result in increased data revenue. The user experience can be improved further by offering new Value Added Services (VAS) based on presence and location information. This will not only boost traffic usage, but new VAS revenue will also improve the ROI.

Is your business looking for the most cost effective yet highly effective solution to lack of cellular reception in your place of business? Small Cells may be the right solution for your business. Contact us for details.

Share this post

10 comments

This is such a major break-through in my opinion. Cell phones are fantastic and we’ve come to rely on them over the last two decades (especially with the launch and spread of smart phones). The problem has always been going certain places where you can’t get a signal, a frustrating experience and one we’re finally seeing a reduction in thanks to DAS.

Mr. O’Brien. You ask, Can someone explain why cell phones don’t seem to work in elevators though?

Think about this. Any good elevator car is made from quality steel products to sustain the weight of passengers and to do so repeatedly over time. Also think about the elevator shaft which is made of strong materials to ensure the elevator car move up and down. Also, many elevators are deep in a building (yes, some are outdoors or close to the outside, but not often). This means the poor cell phone signal has to go through the building’s materials (which can weaken it or even stop it) before it gets to the elevator. By the time the signal is in the elevator area, it still has to go through concrete and steel. Some building install cell phone boosters so your signal is strengthened (which can really help). If not, it’s not uncommon to lose your signal.

These small cell thing sound powerful. Can someone explain why cell phones don’t seem to work in elevators though? I can never get a call when I’m in one.

I noticed the word monetize several times in this blog. Obviously, carriers and other service providers are in it to make money, which is fine. I am glad to see they are also working on increasing data speed and using whatever methods are available to improve the sound quality and to stop dropped calls. One of the things that intrigues me is active DAS vs. passive DAS. I’ve heard of active DAS components, but was unaware of the role of small cells. They seem to be a key piece in improving cell phone signals.

In response to your question Alex, I think I can help. Correct. In real world settings, small cells offer lower latency and strong upload speeds because with an enterprise small cells system, you essentially have “mini cell towers” in your building. This is the same equipment as larger towers of the same service carrier outside so handover is seamless just like you’re driving down the road and switching from tower to tower as you drive along from one place to another. Just like you probably have not noticed dropped calls due to this reason (switching between towers), you will not experience the same when you move away while continuing with your cell call within the building from one cell to another. The same seamless handover scenario occurs when continuing with your cell call from inside the building to outside the building or into your vehicle.

Hi, fantastic article.

I’ve read several places that small cell installations provide far lower latency issues for end users – providing far stronger upload speeds but what is the real world experience? Also, what are the implications for handover if moving between cells? Obviously providing users with a seamless experience is crucial and small cell technology looks like it may be the answer for many awkward installs and coverage areas. Thanks for this article!

Great work. I’m a newbie and I learned a lot from this article. You have a great skill of breaking down the article into bite sized pieces that are easy to read and understand. Now I know more about small cell than the average guy. I wanted to educate myself before I invest in this technology. Thanks so much.

I’m so happy to have come across this blog, I have l learnt a lot about small cell from this article, my cousin tried to tell me what it was all about sometime ago but he was too technical that I didn’t really get most of his explanation, reading this now has given me a better understanding.

Even though this article seems too technical for me, I won’t shy away from admitting that I have learned new things. It is relieving to know that technological advancement is actually correcting the inefficiencies of previous technological breakthroughs. I will definitely read this article again to get the full drill of how a layperson like me can harness the benefits of small cells.

The beauty of this blog is that you take a technical issue that is complex, and break it down into a well-structured explanation that a layperson such as myself can read, understand, and even enjoy. As communication technology continues to change, it is good to know what options are out there. The way the article is written, a business owner can see the pros and cons of small cels without having to call up an expert. As my business continues to grow, I know I will be doing more video conferencing and it’s good to know about all the options. I can’t imagine any client being happy with buffering.